Proofpoint Intelligent Supervision

Next-generation Compliance For Financial Services

INTELLIGENT SUPERVISION

Meet FINRA, SEC and IIROC obligations quickly and effectively. Supervise, review and report on all correspondence. Reduce compliance risks. Streamline regulatory audits and investigations.

Sorry, this product is no longer available, please contact us for a replacement.

Financial services firms face some of the world’s most stringent and complex regulations. Proofpoint Intelligent Supervision helps streamline compliance. It’s fully integrated with Enterprise Archive for easy capture, review and reporting. That means complete visibility across your email, instant messages, collaboration tools and social media.

Financial services firms face the world’s toughest regulatory scrutiny. FINRA, SEC and IIROC require formal retention and supervisory review programs for all communications. To ensure compliance and avoid risk, you need an audit-ready supervision plan.

PROBLEM

- Review teams spend too much time searching for violations and sifting through low risk content

- Legacy solutions are outdated and haven’t kept pace with the way your firm communicates

- Regular audits require proof of supervision

- Fines, penalties and loss of integrity for non-compliance can cost millions

SOLUTION

- Intelligent Supervision enables targeted review and full audit- readiness

- Fully integrated with Proofpoint Enterprise Archive to address regulatory retention requirements

- Broad content support, including email, Bloomberg, instant messages, social and enterprise collaboration data

RESULTS

- Smarter review

- Flexible workflows

- Complete visibility

- Comprehensive audit-readiness

THE CHALLENGE

Maintaining compliance in today’s regulatory landscape is a struggle. Technology has not kept pace with data growth, new content types, or the ever-evolving list of regulations. As a result, firms spend too much time meeting their compliance obligations—or paying hefty fines for failing to do so. Financial firms need a smarter supervision strategy.

PROOFPOINT INTELLIGENT SUPERVISION

Proofpoint Intelligent Supervision is a cloud-based supervisory platform built for even the largest and most complex financial services firms. The next-generation platform helps identify, review, address and maintain audit trails for incoming, outgoing and internal correspondence. It helps you comply with all SEC, FINRA, and IIROC rules far more efficiently than you can with legacy supervision systems or manual tools. We natively support:

- Bloomberg messaging

- Enterprise collaboration platforms

- Instant messages

- Social media

That means your firm is covered for the way it communicates—both today and tomorrow.

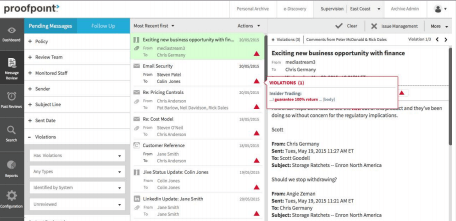

SMARTER REVIEW

Your reviewers don’t need to work harder; they need to work smarter. Intelligent Supervision creates less “noise” for review teams to sift through. That means you can pinpoint compliance violations faster and more accurately. Here are just a few of the benefits:

- Advanced violation detection Ignore pre-approved content and waste less time reviewing false positives.

- Intelligent sampling by message type Skip low-risk content, including bulk mail.

- Violation previews Decide whether to review without having to read the entire message body.

- Advanced message filters Target, refine and prioritize the review queue.

- Conversation threading Group and review related messages in a single step.

CUSTOMIZED WORKFLOWS

A next-generation supervision solution must be flexible. It must meet the evolving needs of your business. And it must never force you to build your processes around outdated technology.

Intelligent Supervision provides a new level of flexibility to optimize your supervision strategy as your needs change. You get:

- Isolated administration, access and reporting help maintain privacy and security.

- Provide greater scrutiny by employee or violation type.

- Get proven performance for even the largest and most complex firms.

COMPLETE VISIBILITY

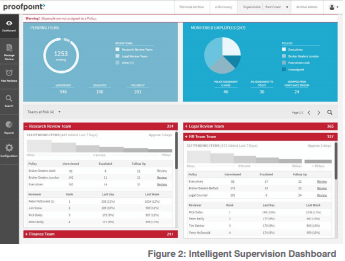

Poor visibility in the supervision process can slow regulatory response. Intelligent Supervision solves this problem in three powerful ways: It identifies bottlenecks, improves collaboration and boosts productivity to reduce compliance risks.

You get rich, visual reporting tools for all archived content. Armed with actionable intelligence, you’re always ready to protect your firm.

- Monitor the progress of review to identify review teams that are falling behind.

- Compliance administrators can ensure that all reviewers are completing their assigned review work on time.

- Reviewers and compliance teams know when queues grow beyond set thresholds.

COMPLETE AUDIT-READINESS

Intelligent Supervision keeps you ready to respond to regulatory audit requests at a moment’s notice. Here’s how:

- All review activities are fully audited.

- Policy tracking allows you to demonstrate the history of rules, supervised employees, and reviewers at any point in time.

- Evidence of review reports prove you are in compliance with your stated policy.

- You can easily export the full history of review activities and comments to auditors in the industry-standard .PST format.

INTEGRATION WITH PROOFPOINT ENTERPRISE ARCHIVE

Separate archiving and supervision tools increase management overhead and costs. Proofpoint Intelligent Supervision is fully integrated with Proofpoint Enterprise Archive for easy capture, review and reporting. Enterprise Archive allows financial organizations to govern and discover a wide range of data to address all requirements outlined by SEC 17a3-4.

Proofpoint provides FINRA,SEC and IIROC regulated firms with unmatched visibility and improved productivity to streamline regulatory compliance and reduce overall risk.

Documentation:

Download the Proofpoint Intelligent Supervision Datasheet (PDF).